There’s a ton of negativity surrounding interest rates. First-time buyers are considering what impact these increased interest rates are going to have on their capacity to buy and property and if they should delay purchasing their new home.

Let’s start by stating the obvious – It is never good when mortgage interest rates go up. We would all like to pay as little as possible, for as long as we can. However, the fact that we are now looking at rates of approx. 4% for most first-time buyers, isn’t a reason to step away from purchasing.

The fundamental rule of property buying remains: If you can find a property, that meets your needs, in an area where you’d like to live, and the repayments are affordable – then go for it! Especially when the alternative is to continue to pay extortionate rents.

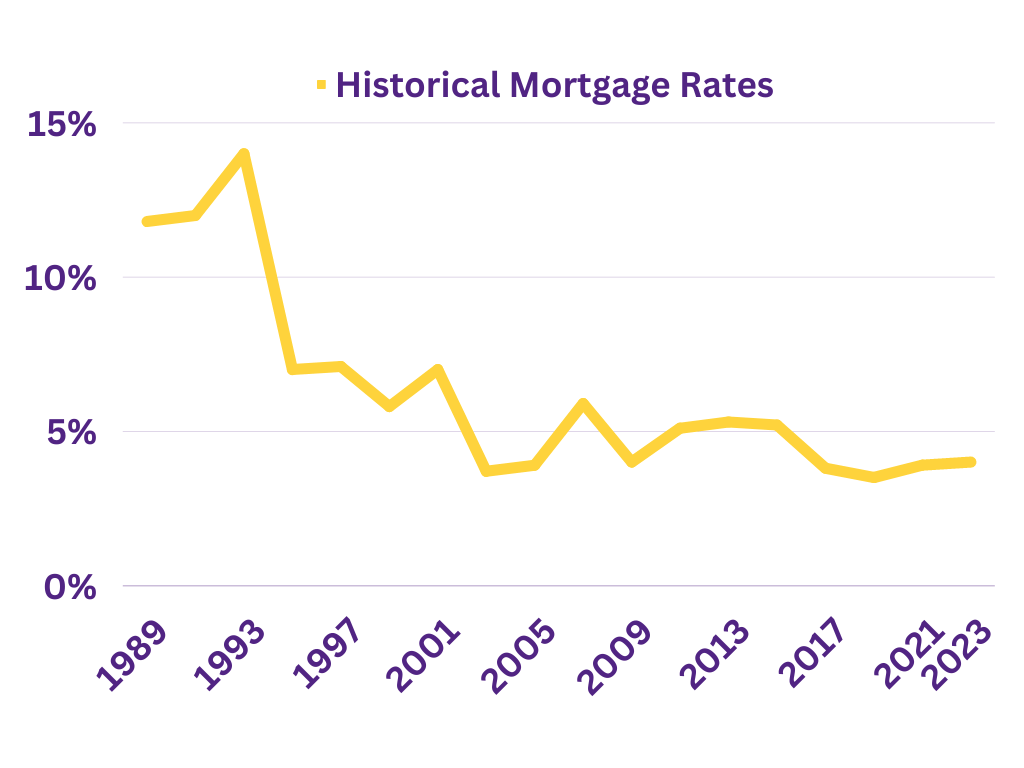

It’s important to note that while interest rates are increasing, they’re coming off a historically low base.

banking and payments federation report

The average first-time buyer today (aged 34) would have been a small child when interest rates peaked in 1993. Luckily, we’re not looking at these types of rates in today’s market! Today’s interest rates are in fact more like the average rate of 4.6% during the Celtic Tiger Property bubble (2002-2008).

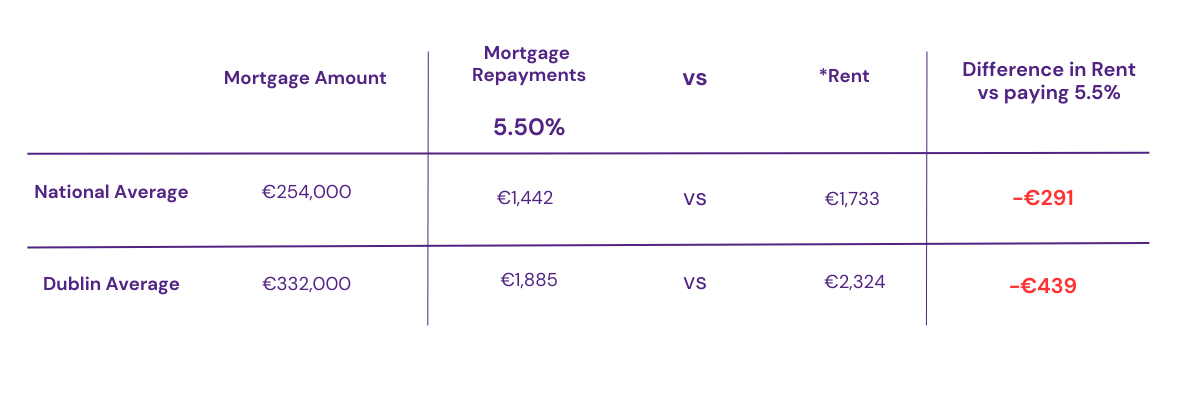

The table below outlines what today’s average rate of 4% (and the media-reported potential rate of 5.5%) looks like for the typical borrower.

*Average rent figures are taken from the recent DAFT report

We are not trying to say that these are affordable, or that increases of this size won’t affect your budget. But, when compared to the alternative, which is rent, even the ‘potential’ 5.5% looks like better value – €439pm cheaper than rent. Which is over €5,000 per year!

What we are saying is that current interest rates are not a reason to avoid buying a house. Interest rates have a dual effect. Yes, they increase the cost of borrowing, but they also tend to slow down the rate of price increases in the property market. We have seen house prices fall slightly in the last couple of months and it’s reasonable to assume that this was, in part, due to the rise in interest rates. Every cloud has a silver lining.

At Humdinger Mortgages, it’s our job as your Mortgage Advisor to help you get on the property ladder and find the right mortgage to suit your needs. We will help you to stress test your finances so that you can be confident you won’t struggle to maintain your repayments.

Don’t be put off by doom-mongering headlines in the media. We’re here to help.